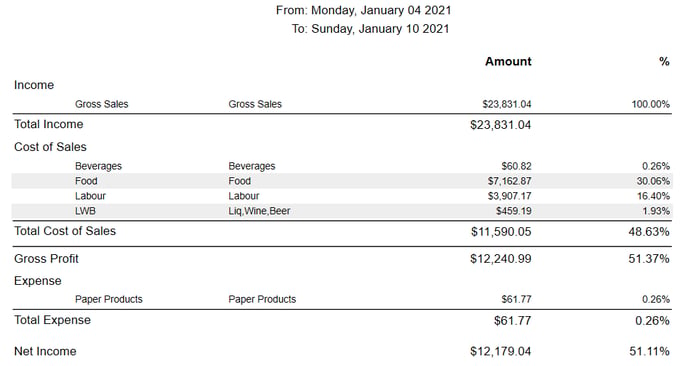

Profit & Loss

The Profit and Loss report will display the account totals to calculate net profit. The P&L will need to be run based on the inventory periods to generate the net profit.

| Header | Detail |

| Income | Income is on the sales that have been entered. |

| Cost of Sales | This will display the account purchases that are applied to the account type "Cost of Sales". |

| Expense | This will display the account purchases that are applied account type "Expenses". |

| Net Income | Profit generated in the reporting range. Net Income = Total Income - (Total Cost of Sales + Total Expense) |

*Note: If an account shows up in the wrong section (Expense vs. Cost of Sales), you will need to go into Setting -> Setup -> Account and update the account type.\